Latest Articles

View our recent updates.

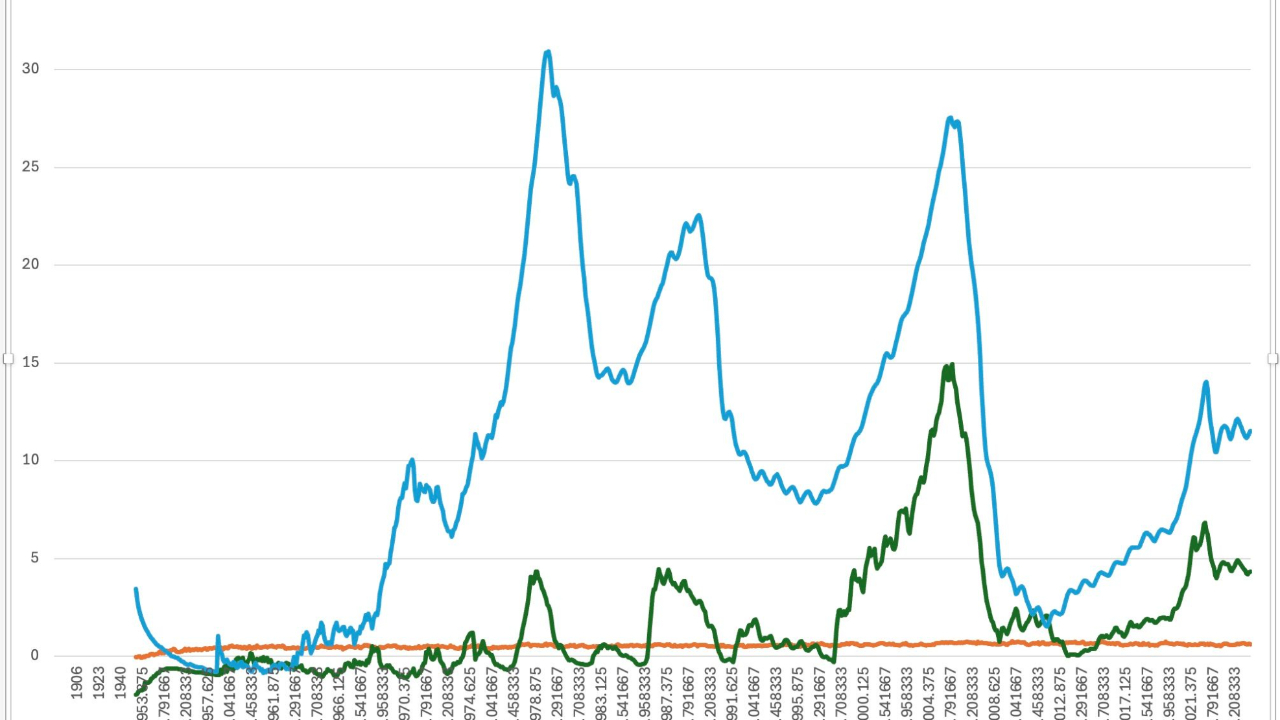

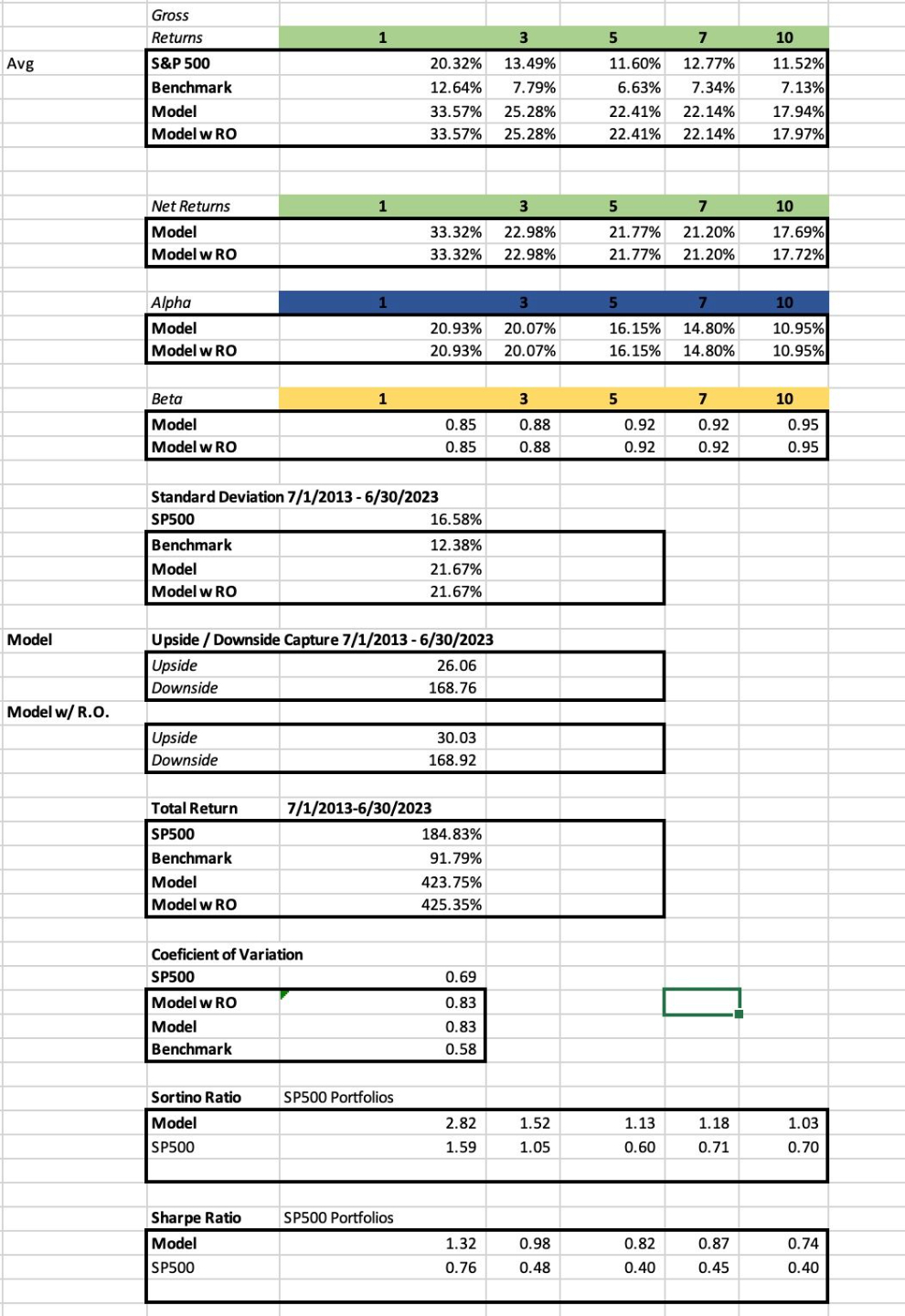

Mastering the All-Weather Portfolio: Tactical Allocation with the Lutey Recession Indicator

A groundbreaking study in the Journal of Portfolio Management just dropped, and it's a game-changer for anyone serious about blending growth and value strategies. It explores an "all-weather" portfolio that ...

I found my old Blogger posts from 2014-2019. Prior to starting on the CAN SLIM Newsletter and Famous Investor Portfolio Project. They cover life in South Florida and moving to New Orleans and the start of my PhD in Financial Economics.

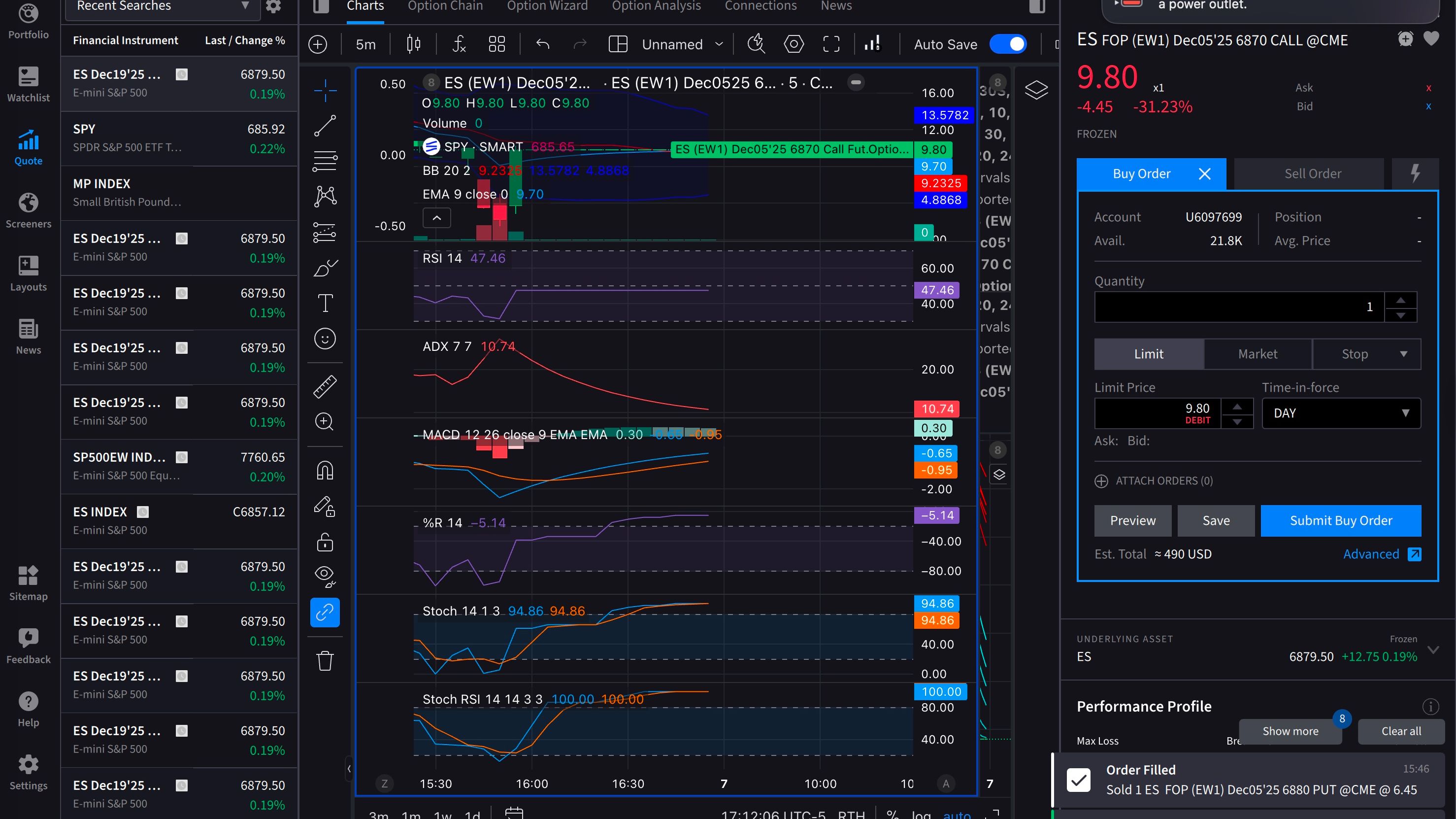

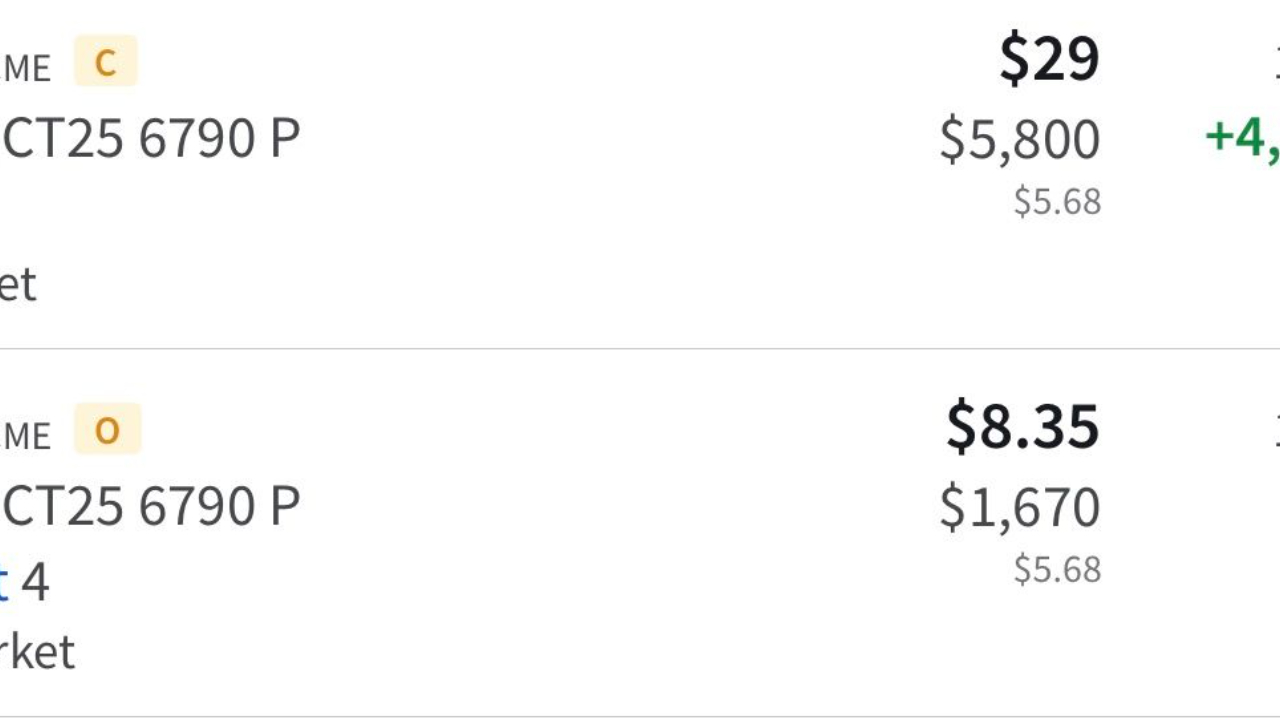

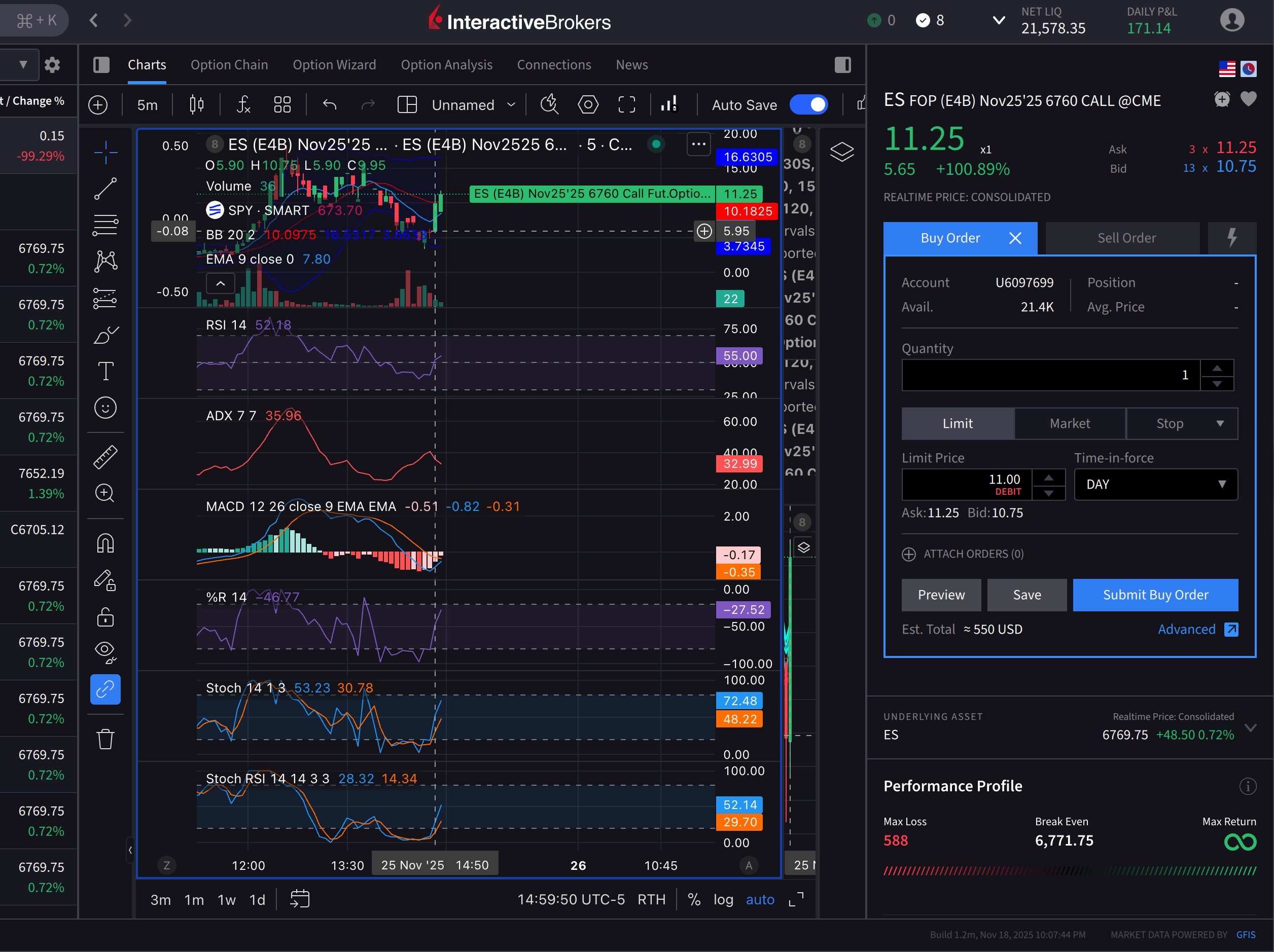

I've noticed that there is an optimal area to place bets on options with futures based on the time decay and strike price. For example: An option with an expected move close to expiration shows strong movement at one strike, vs no movement in another.

Price formed a bounce on the support 4 level a...

The SP500 (SPY) showed a VPCI VBOT reading on Nov 24, 2025. Historically this reading has produced profitable investing signals when tested on the 11 Sector SPDR ETFs. This result is published in the Journal of Beta Investment Strategies (2025).

I put together a course on futures and options. It covers technical trading signals I use on them. For example:

This $5.95 call option was a good buy signal following my trade book rules at 2:50pm. 10 minutes later it popped up to $11.25 making it a almost 2:1 trade with $300 risk.

Looking bac...

The economy is a fascinating, unpredictable beast, isn’t it? One minute, we’re riding high on growth and optimism, and the next, we’re staring down the barrel of a potential correction—or worse, a crash. If you’ve been paying attention to the housing market and the stock market lately, you might be ...