About Us

Our Story

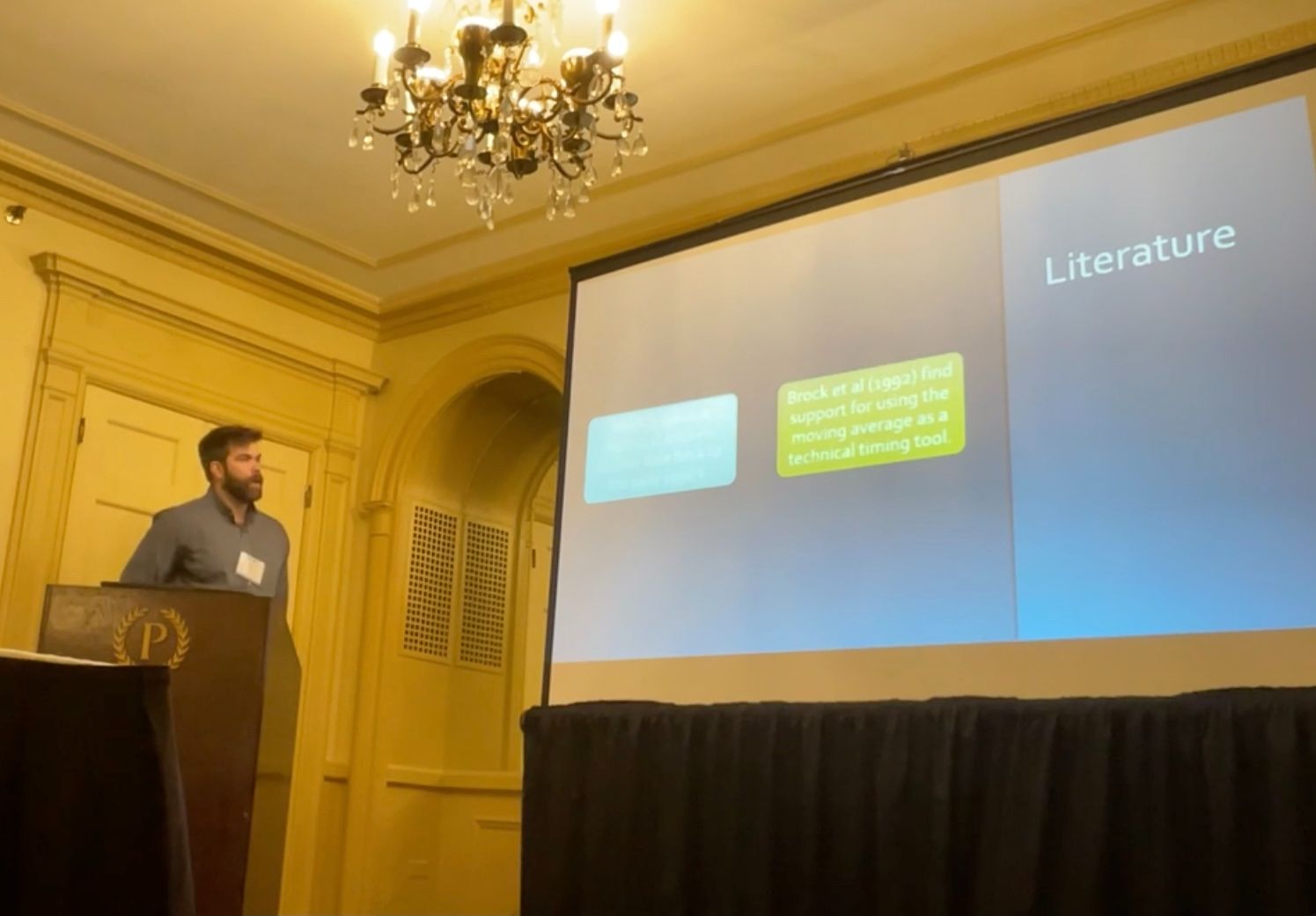

We began working with the CAN SLIM system in 2013 while researching it for a financial planning firm in Upper Michigan. The model we developed was backtested and went on to win the Best Paper Award at the American Society of Business and Behavioral Sciences (ASBBS) conference in Las Vegas, NV. It was revised and updated twice between 2014 and 2015, and again received national publication attention.

The system drew attention from practitioners in engineering as well as fellow academics. It even turned heads at conferences, sparking several “I’d like to invest with you” conversations.

After receiving a call from an investment entrepreneur who wanted to independently invest $100,000, we decided it was time to take action.

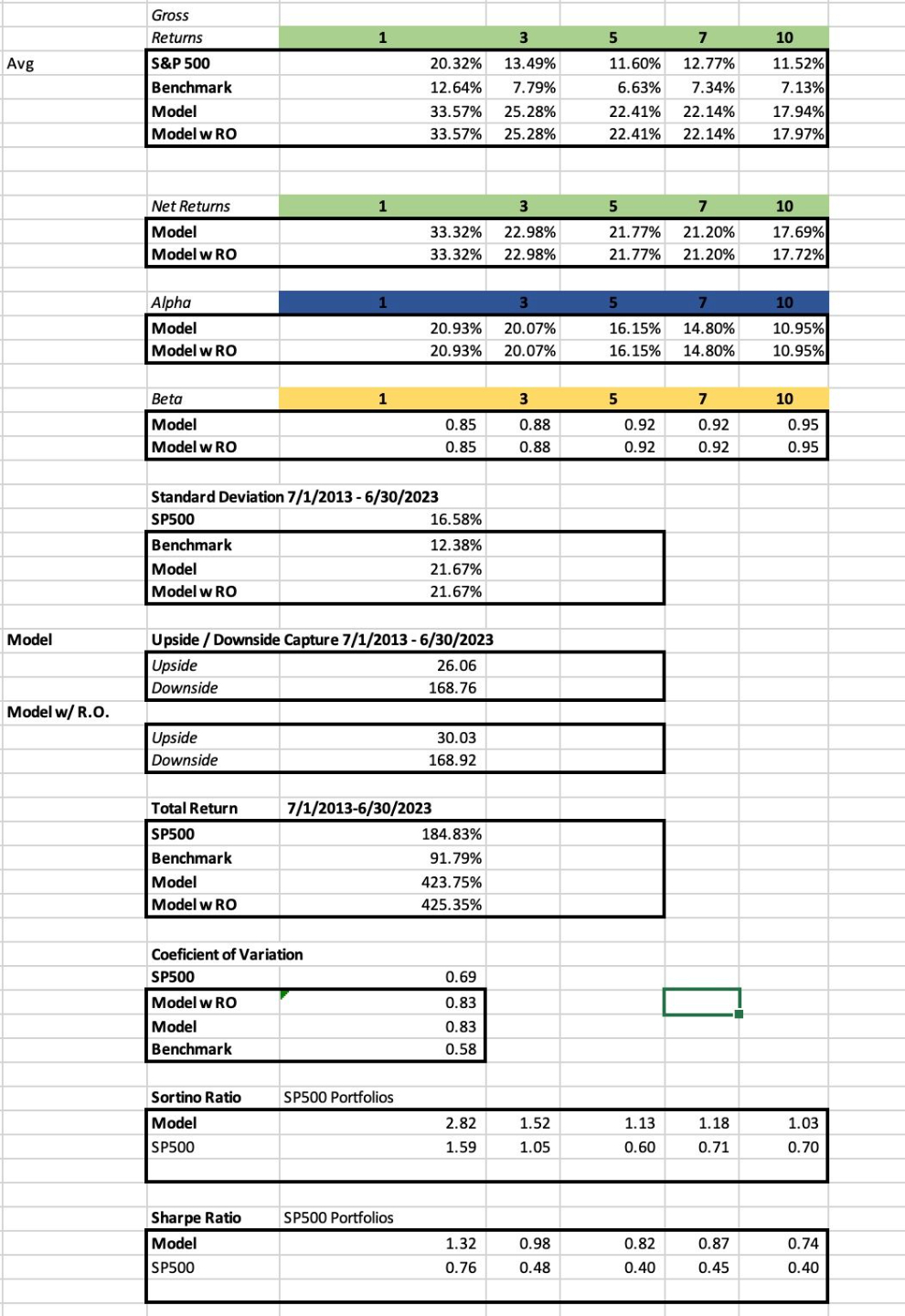

After rigorous backtesting, stress testing, peer review, and reframing the portfolios as CAN SLIM vs. the rest, we determined that the Warren Buffett, Benjamin Graham, and Joel Greenblatt portfolios—along with two newly developed models, the Simplified CAN SLIM and the Volume Price Confirmation Indicator (VPCI) portfolios—deserved a place in the lineup.

View the SP500 Passing CAN SLIM Stocks

Learn how to lower portfolio risk with our models. Protect alpha in market downturns and tactically allocate between equity and bonds while selectively choosing which sectors you are exposed to during specific market conditions.

View the models

About Matt

Matt is a finance PhD (University of New Orleans, 2019) and professor (Indiana University and Morehouse College). He builds models that track best performing stocks based on fundamental and technical properties that show the strongest fundamental and momentum properties with a proven track record of out performance. He builds university classes that meet the students at their level and brings them through the material through learning by doing.

He has more than 30 research publications in outlets such as the Journal of Portfolio Management, Journal of Investing, Journal of Beta Investment Strategies, Journal of Academy of Business and Economics, Journal of International Finance and Economics, Journal of Business and Behavioral Sciences, Journal of Accounting and Finance and others. He has presented at 25 international and national academic conferences since 2020. He has also been invited to present at the Student Managed Investment Fund Consortium (SMIFC-South) (Orlando) and Chartered Market Technician (CMT) Web Series on practical sector investing and long-term investment strategies. His research was showcased both by Indiana University (IU) and Morehouse College media.

He has facilitated his students presentations at outlets like the Student Managed Investment Fund Consortium (Chicago, IU 2021-2023) and Historically Black College University (HBCU) Stock Pitch Competition (Boston, Spelhouse 3rd place!). As well as international conference presentations in Hanoi, VT (Philip Mitreski), and national conference presentations in San Diego, CA (Sogand Tayebinaz), Los Angeles, CA (Philip Mitreski, best paper award!) and Galveston, TX (Philip Mitreski). The research with Mitreski was featured in IU's news and events.

His courses feature practical investment philosophy and practice. Students have won first place in categories such as single best trade (Jason Lihct - IU 2021) and lowest maximum drawdown (Spencer Peters - Morehouse 2025) competing against 40+ other universities from 47+ countries with the CMT simulated trading competition.

He has bought real-estate for investment property at 21 while a Junior Undergraduate student and again during Covid-19. His trading experience and hobby stemmed from attending the Student Managed Investment Fund (SMIF) at Northern Michigan University (NMU) and later served as the president of the fund during 2013.

His research as an MBA student won the best paper award at the American Society of Business and Behavioral Sciences (ASBBS) conference in Las Vegas, NV. The paper was published in their e-journal in 2013. This achievement was featured in NMU's business Horizons magazine.

His research philosophy features practical investment strategies that outperform the SP500. The motivation is for further future out performance that every day people can follow regardless of background. The goal is to outperform the broad market using fundamental and technical analysis. The justification is the expensive time needed to conduct studies, and cost of data is offset through economies of scale and limited investment cost to the end-user.

The site is an education platform that shows portfolio strategies that outperform the market historically, recession signals, day-trading strategies, investment courses and financial modeling courses. Key takeaways are:

- 15 years of research experience and building models that outperform the market.

- Applications that show the models continue to outperform in real time after publication.

- Data used with point-in-time survivor-bias free estimates from the Center for Research in Security Prices (CRSP) and Fact Set via Portfolio123.com.

Work with Matt

Learn how to lower portfolio risk with our models. Protect alpha in market downturns and tactically allocate between equity and bonds while selectively choosing which sectors you are exposed to during specific market conditions.

View the models