A real time sector regime switching model

Jan 24, 2026Mastering the All-Weather Portfolio: Tactical Allocation with the Lutey Recession Indicator

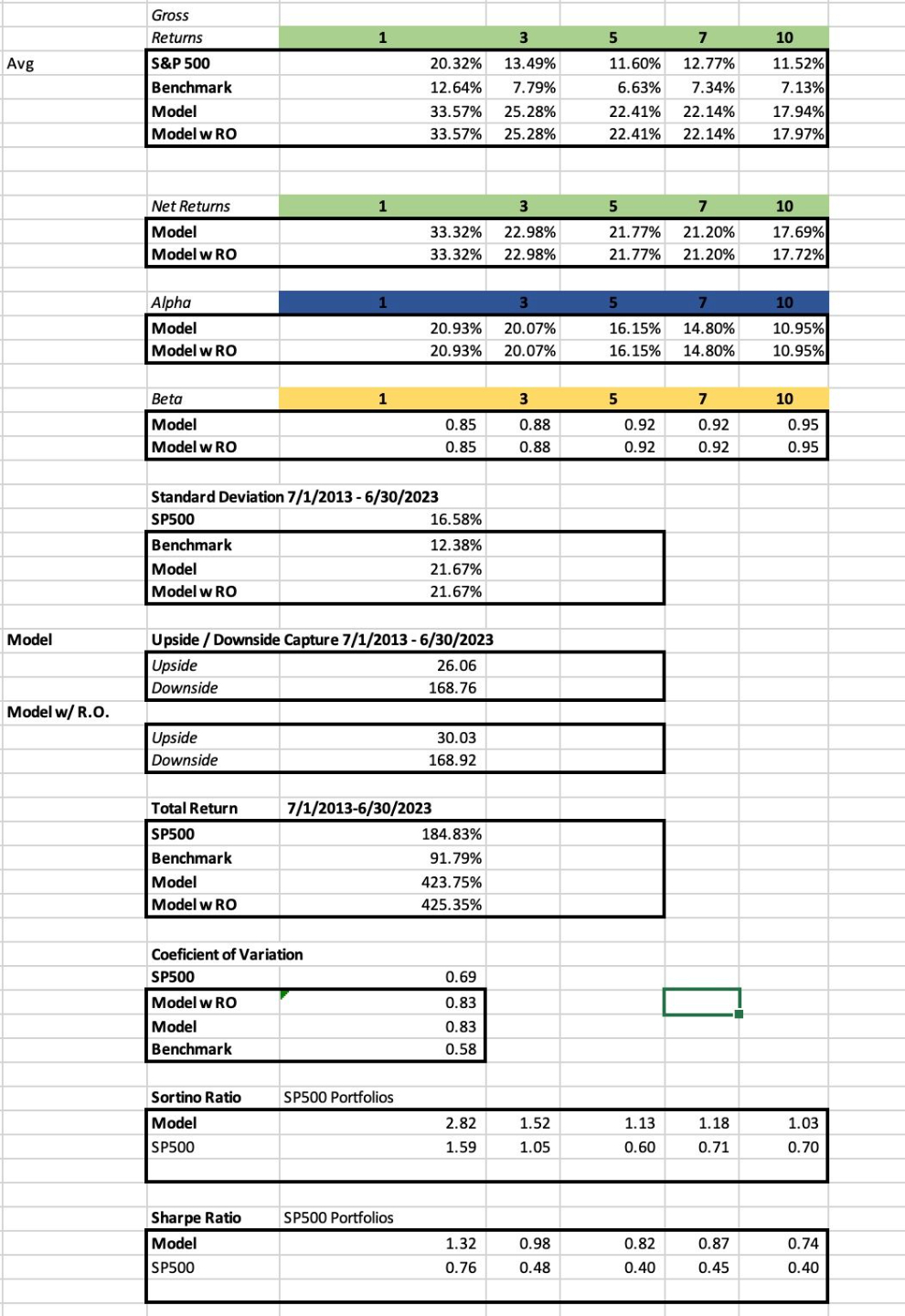

A groundbreaking study in the Journal of Portfolio Management just dropped, and it's a game-changer for anyone serious about blending growth and value strategies. It explores an "all-weather" portfolio that dynamically switches between market conditions—tracking macro signals like interest rates and announcements—while tactically allocating across my Lutey Growth "CAN SLIM," Lutey Moderate Growth "Simplified CAN SLIM," Lutey Value "Warren Buffett," and Lutey Growth "Benjamin Graham" portfolios.

The core idea? Build exposure to both growth and value styles, but shift your stocks-to-bonds allocation based on the Lutey Recession Indicator. Here's the simple framework:

Expansionary Growth (LRI Normal): 80% stocks / 20% bonds – Ride the broad market upside.

Late-Stage Bull (Trending Up on Declining Volume + Prior Inversion): 70% stocks / 30% bonds – Dial back as momentum fades.

Death Cross + Confirmed Inversion Length: 60% stocks / 40% bonds – Prioritize preservation when recession risks solidify.

This isn't wild speculation. It's calibrated risk management.

Why These Shifts Actually Work (The Intuition)

What sets the Lutey Recession Indicator apart is its patience—it waits for clusters of confirming signals before acting. No knee-jerk reactions to one headline or data point. Instead:

Yield Curve Inversions: Not just if they happen, but how long they persist. Duration signals real monetary stress.

Declining Volume on Upside: Price gains without conviction? That's a warning of underlying weakness.

Death Cross Confirmation: The long-term moving average crossover (50-day over 200-day) seals it, showing structural shifts.

Early-cycle markets love aggressive equity tilts and growth leaders. Late-cycle? Go selective. Recession-threatened? Protect capital and stay flexible.

This turns allocation into smart risk calibration—not a coin-flip bet on timing the top or bottom.

Ready to Build Your All-Weather Portfolio?

Want to dive deeper? Work with me to:

Optimize stocks/bonds splits using the Lutey Recession Indicator in real-time.

Select the right stocks blending growth (CAN SLIM/Simplified) and value (Buffett/Graham).

Construct a resilient portfolio that thrives across cycles.

Book a 15-Minute Strategy Session – We'll map your exact allocation and holdings. Limited spots—let's make your portfolio recession-proof.

What market signal are you watching closest right now? Drop a comment below.

P.S. The full study details are in the latest newsletter—grab access here.