Latest Articles

View our recent updates.

Our VPCI portfolio for All Stock has been updated for June 2025. The model’s strong track record since 2000 continues, with strategic buy and sell decisions optimizing returns. This month’s rebalance includes positions in Mndy and Uber reflecting our commitment to disciplined, data-driven investing....

June brought some clear winners according to our CAN SLIM stock evaluation. Top performers like TOST and CHWY stood out due to strong fundamentals and technical signals. Our model continues to highlight sectors showing resilience in this market environment. Dive into the full analysis for actionable...

Earlier today, I had the privilege of presenting my latest research to the CMT Association as part of their educational web series. The topic: how volume-based overlays and the principles of legendary investors can work together to produce more robust, risk-adjusted investment strategies.

Overview ...

Volume Price Confirmation Indicator VBOT Strategy on Sector SPDR ETFs

We construct the Volume Price Confirmation Indicator (VPCI) VBOT signal using the 11 S and P sector exchange-traded funds. The indicator is based on a lower standard deviation band below the simple average of the VPCI itself. The...

My undergraduate finance students participated in a competition for pitching a stock (Zoom 'ZM') at the HBCU Boston Stock Pitch Competition sponsored by Wellington Capital. They completed a discounted cash flow analysis, multiples valuation and overall market share / storyline for the stock and comp...

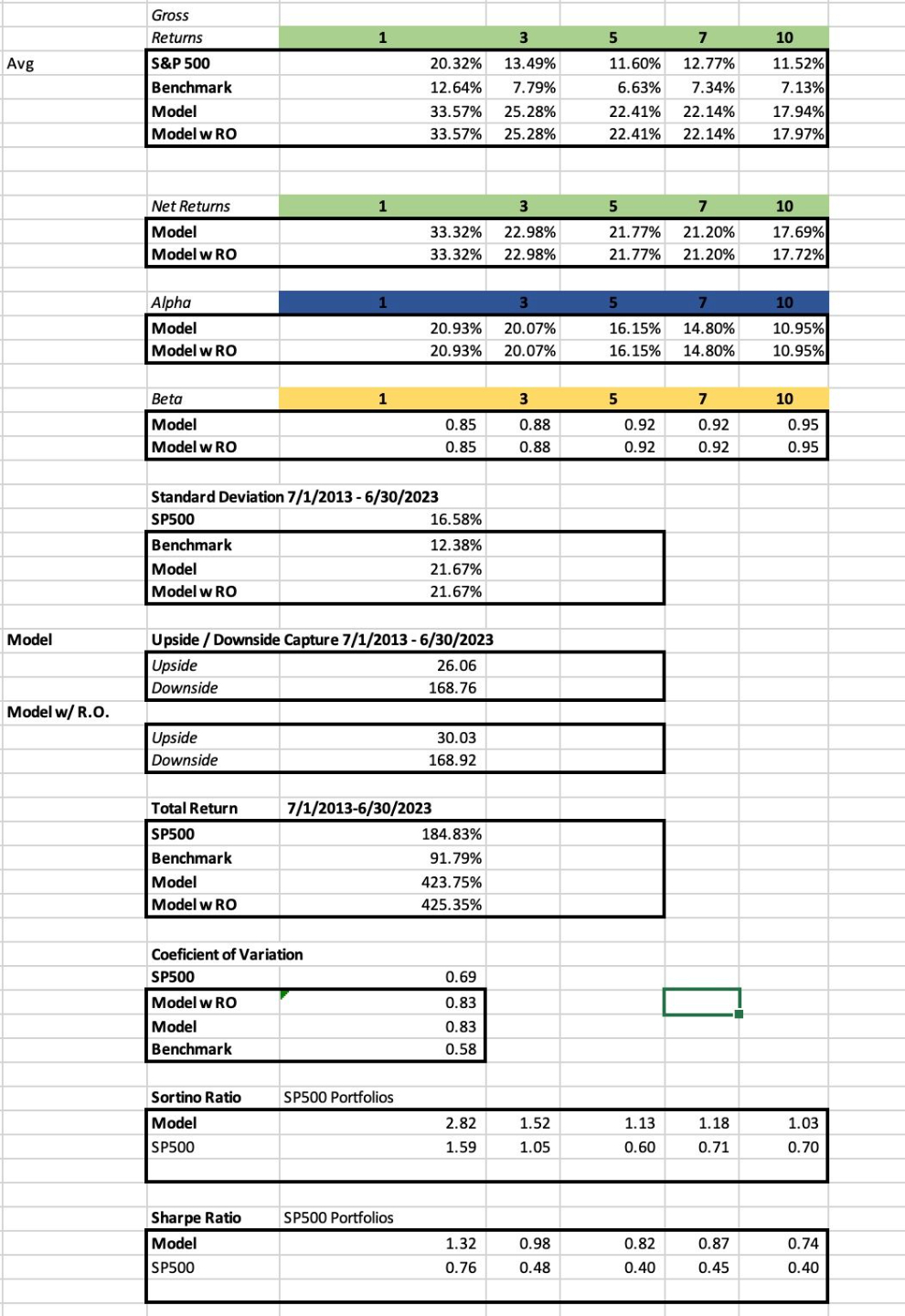

I combined the Volume Price Confirmation Indicator with a Moving Average Trend Factor and Yield Curve Factor to create a 3 factor model for investing. Yield Curve Decile 6 combined with VPCI Decile 6 and Moving Trend Factor provides superior results over the benchmark and buy and hold (and each fact...