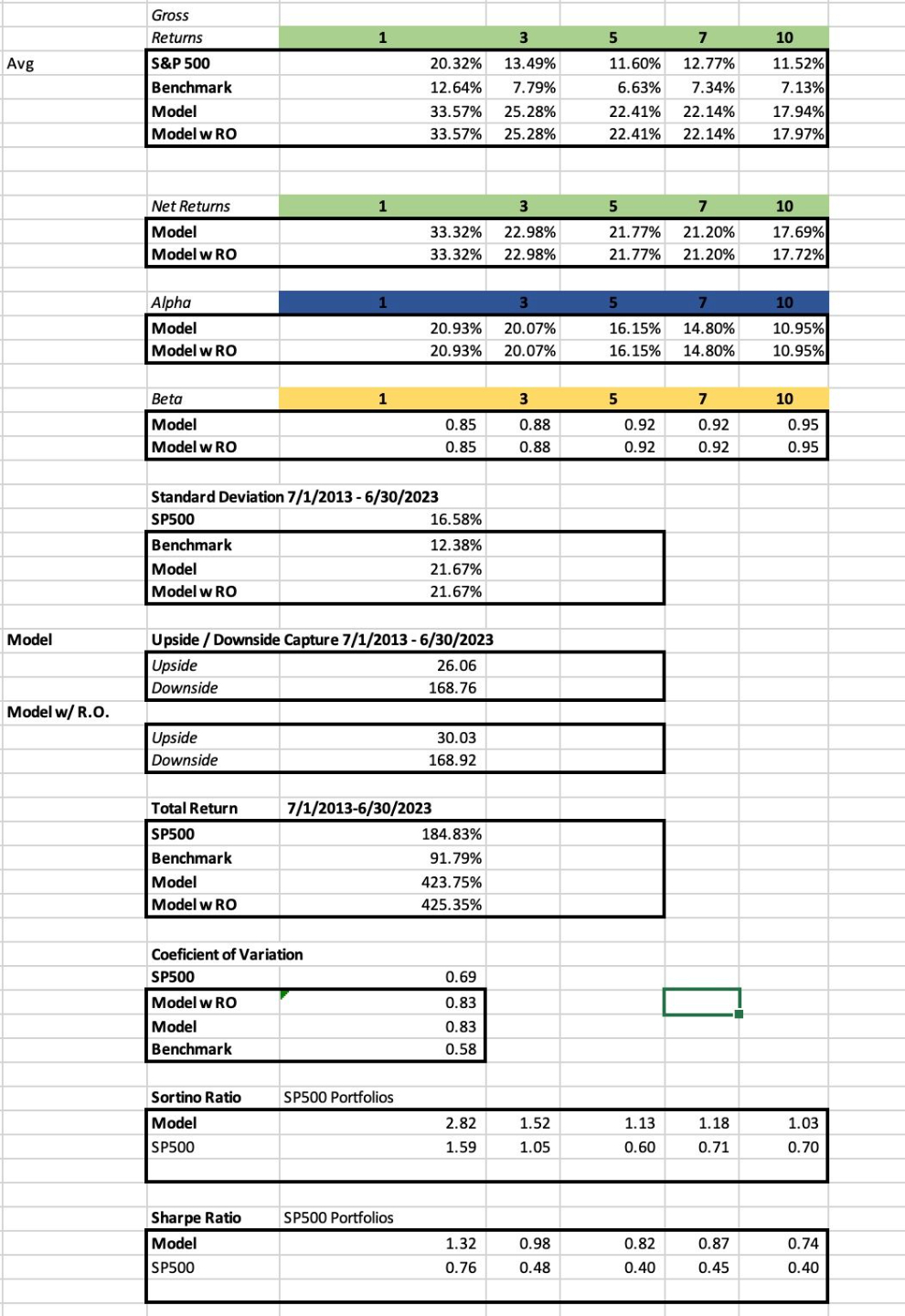

Options on Futures values at varying strikes

Dec 11, 2025I've noticed that there is an optimal area to place bets on options with futures based on the time decay and strike price. For example: An option with an expected move close to expiration shows strong movement at one strike, vs no movement in another.

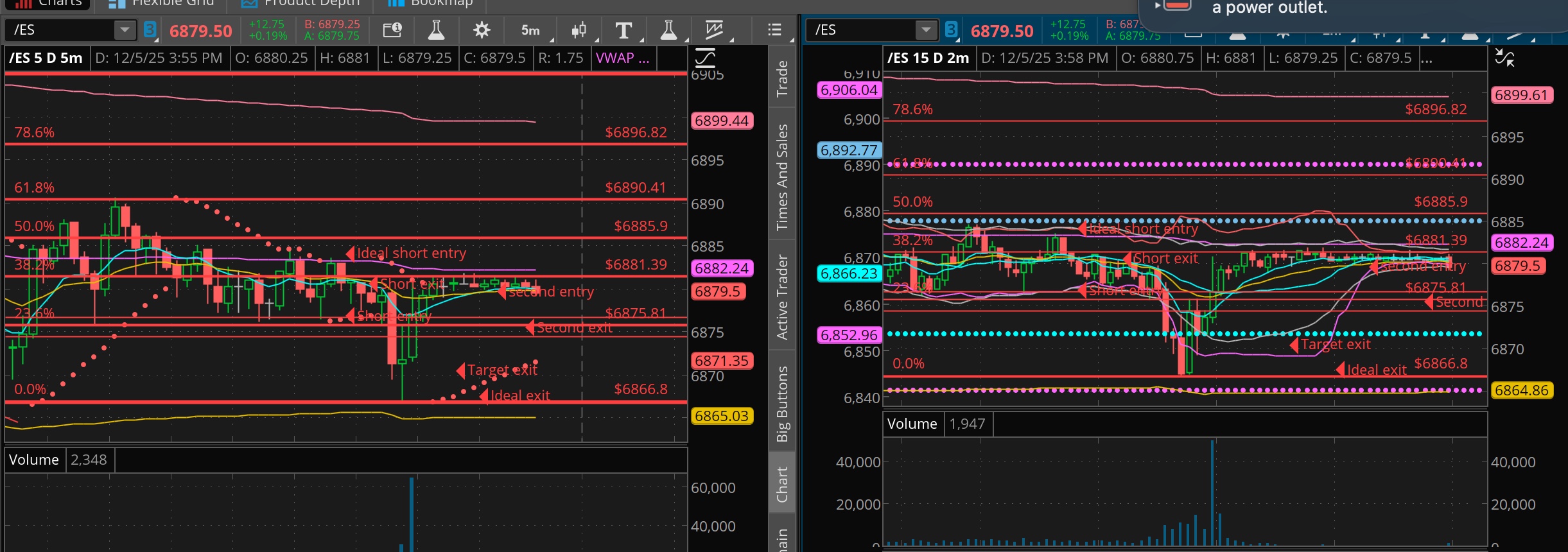

Price formed a bounce on the support 4 level at the end of the day on Dec 5th. Before the bounce the option was basically flat:

The total move with the hammer on the 5m chart touching the lower fibonnacci level also happens to be stacked on top of the Camarilla Pivot Point support 4 level. This is at 3:50pm 10 minutes before market closes.

The total move with the hammer on the 5m chart touching the lower fibonnacci level also happens to be stacked on top of the Camarilla Pivot Point support 4 level. This is at 3:50pm 10 minutes before market closes.

This move usually produces a bounce at any time of the day and often a subsequent trend. Usually price alone can detect a move.

Ideal entries are hard to come by - but if you noticed the move at the bottom of the fibonaci level on the 5m chart you'd catch the option at around $1.30. At the end of the move - a few minutes later it was worth $9.80. That is about 8:1 return to risk ratio.

You do the math 😍