Follow the proven models of investment research.

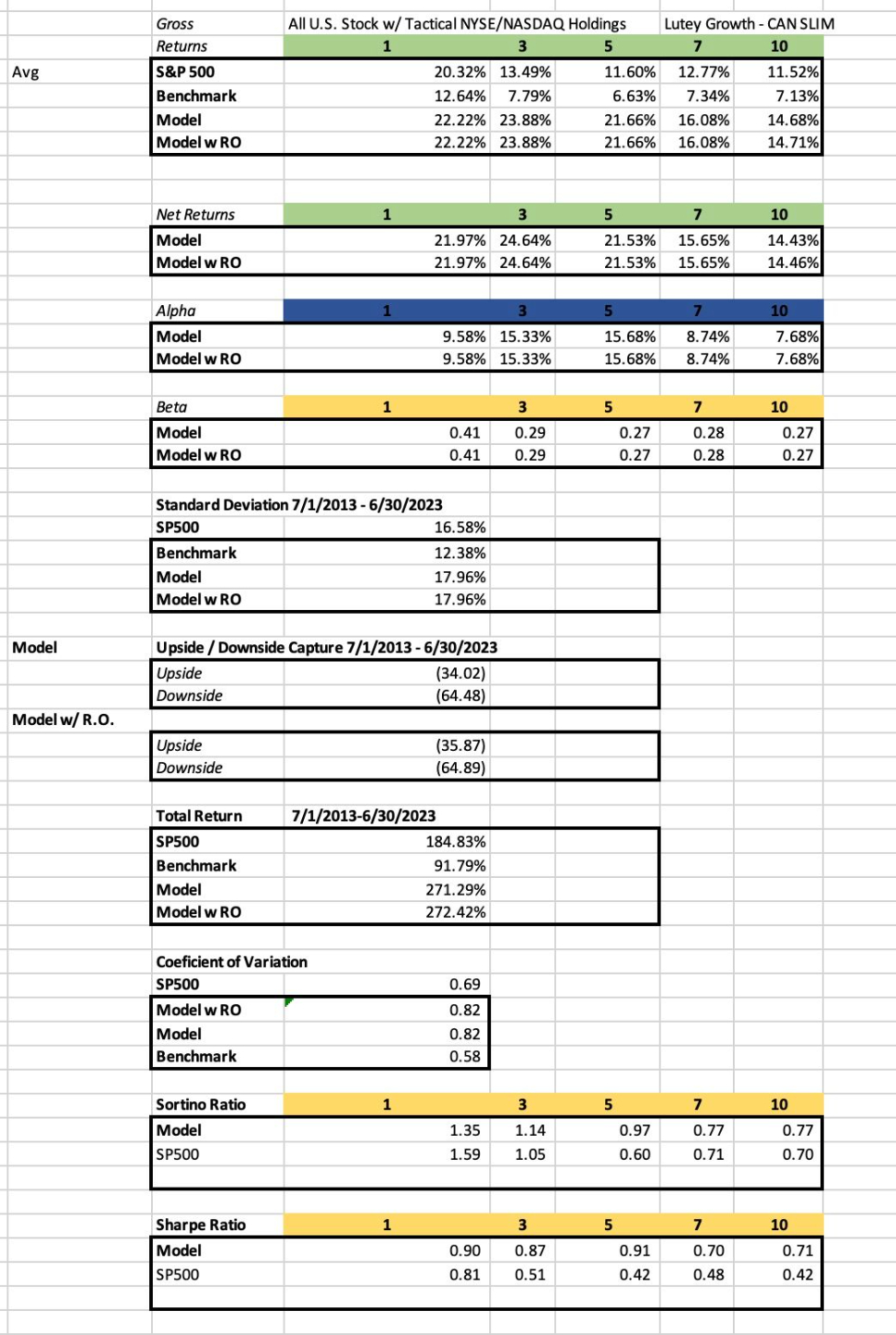

Learn the ins and outs of every portfolio - and how to combine them in an optimal framework which provides a 2% improvement annualized return over the SP500 along with a 2% reduced Standard Deviation over the SP500 during 2013-2023. See the case study below:

Currently offering investment for June 2026 cohort of individuals and financial planners who want to master their finance. Learn from the best to deploy the best tools and framework to keep your portfolio safe in 2026 and beyond - following the proven methods of research.

"Lutey Value - Warren Buffet - Produced a 9% real time return while Lutey Growth - CAN SLIM - produed a 8.86% real time return from Nov '2025' - Jan '2026' compared to the SP500 return of 3.99%"

-ex-Goldman Sachs and -ex-Amazon professionals Who founded: Pi Trade

Automated copy trading platform that deploys the Lutey Growth and Value CAN SLIM / Graham / Buffet Portfolios for individual investment.

Lutey Tactical Portfolio Switching

Growth + Defensive: +130% total excess returns over the SP500 from 7/1/2013-6/30/2023. With 3% lower standard deviation.

Without Overlay: 277% | High volatility | 164% downside

With Recession Overlay: 315% | 13.2% vol | Elite alpha (8–12%)

Overlay Impact:

+38% total return

+1–2% annual alpha

17% vol reduction

Sharpe 1.01 (5Y)

High-octane CAN SLIM + Graham

Recession protection turns raw growth into advisor-ready alpha.

Institutional growth sleeve – systematic, scalable, survivable.

Lutey Tactical Growth: CAN SLIM → Risk Overlay → Recovery Rotation

Here's the dynamic flow of your flagship growth model, powered by Lutey Recession Rules:

1. Expansion (Full Growth Mode)

80/20 Equity/Bonds

CAN SLIM + Graham

Momentum leaders + value screens

Max upside capture (215% market)

LRI Signals: Normal yield curve + bullish volume

2. Late Cycle Warning (Tactical Shift)

70/30 Equity/Bonds -> 60/40 Equity/Bonds

Risk Overlay Activates

Momentum rules dial back exposure

Tactical risk overlay + value tilt for protection

LRI: Yield inversion + slowing breadth

3. Confirmed Sell-Off (Risk OFF)

50/50 Equity/Bonds

Buffet Lutey Value + Tactical Overlay

Defensive value screens

Momentum filters kill losers

Capital preservation priority

LRI: Death cross + volume failure

4. Early Recovery (Value Ramp)

60/40 -> 70/30 → Gradual Re-Entry

Buffet Lutey Value + Tactical Overlay

Mean reversion winners

Tactical momentum confirms base

LRI: Inversion unwinds

5. New Cycle (Back to Growth)

80/20 Full Offensive

Growth CAN SLIM Momentum Returns

Leadership rotation

Growth screens dominate

LRI: All signals green

No More "Always Growth" or "Always Value" Traps

Learn to rebalance now

The Lutey Recession Indicator's Defensive Dance – From Uptrend to Offensive Recovery

1. Uptrend → Initial Defense (Yellow Light Regime)

Signal: Prolonged yield curve inversion + declining volume on rallies.

Marketing Angle: "While everyone's piling in, you're tactically dialing back. 80/20 stocks/bonds shifts to 70/30. You're not timing the top—you're calibration. Smart money preserves gains before the storm hits."

Emotion: Prudent foresight. "Sleep easy knowing you're ahead of the herd."

2. Sell-Off Confirmation → Full Defense (Red Light Regime)

Signal: Death cross + confirmed inversion length.

Marketing Angle: "Market cracks? You drop to 60/40 instantly. No emotion, just rules. While panic sells, your capital stays intact."

Emotion: Ironclad protection. "Your portfolio's bunker—battle-tested drawdown control."

3. Post-Sell-Off → Gradual Lift (Green Light Approach)

Signal: Inversion unwinds + volume confirmation.

Marketing Angle: "Don't FOMO all-in. Slowly scale back to 70/30, then 80/20. Patient re-entry captures the bottom without guesswork."

Emotion: Disciplined patience. "You're buying the real bottom, not the headline bounce."

4. Full Recovery → Offensive Mode

Signal: LRI normalizes + bullish volume.

Marketing Angle: "All clear? Ramp to full equity exposure. You've protected capital and positioned for the boom—alpha on both sides."

Emotion: Victorious momentum. "Win the cycle, not just survive it."

Lutey Moderate Growth - Simplified CAN SLIM Model

Simplified CAN SLIM (Adjusted CAN SLIM / ACS): Overview

Simplified CAN SLIM strips the original CAN SLIM framework down to its two most powerful and observable drivers of outperformance:

-

Strong earnings growth

-

Strong price momentum near highs

Rather than attempting to operationalize all seven CAN SLIM letters (C-A-N-S-L-I-M), which is complex and difficult for most investors to replicate, the simplified model focuses only on earnings acceleration + price confirmation.

The result is a rules-based growth strategy that:

-

Is easy to screen and automate

-

Requires minimal subjective judgment

-

Has historically outperformed the S&P 500 with higher returns, lower beta, and better risk-adjusted performance

View the Lutey Moderate Growth - Simplified CAN SLIM Fact Sheet

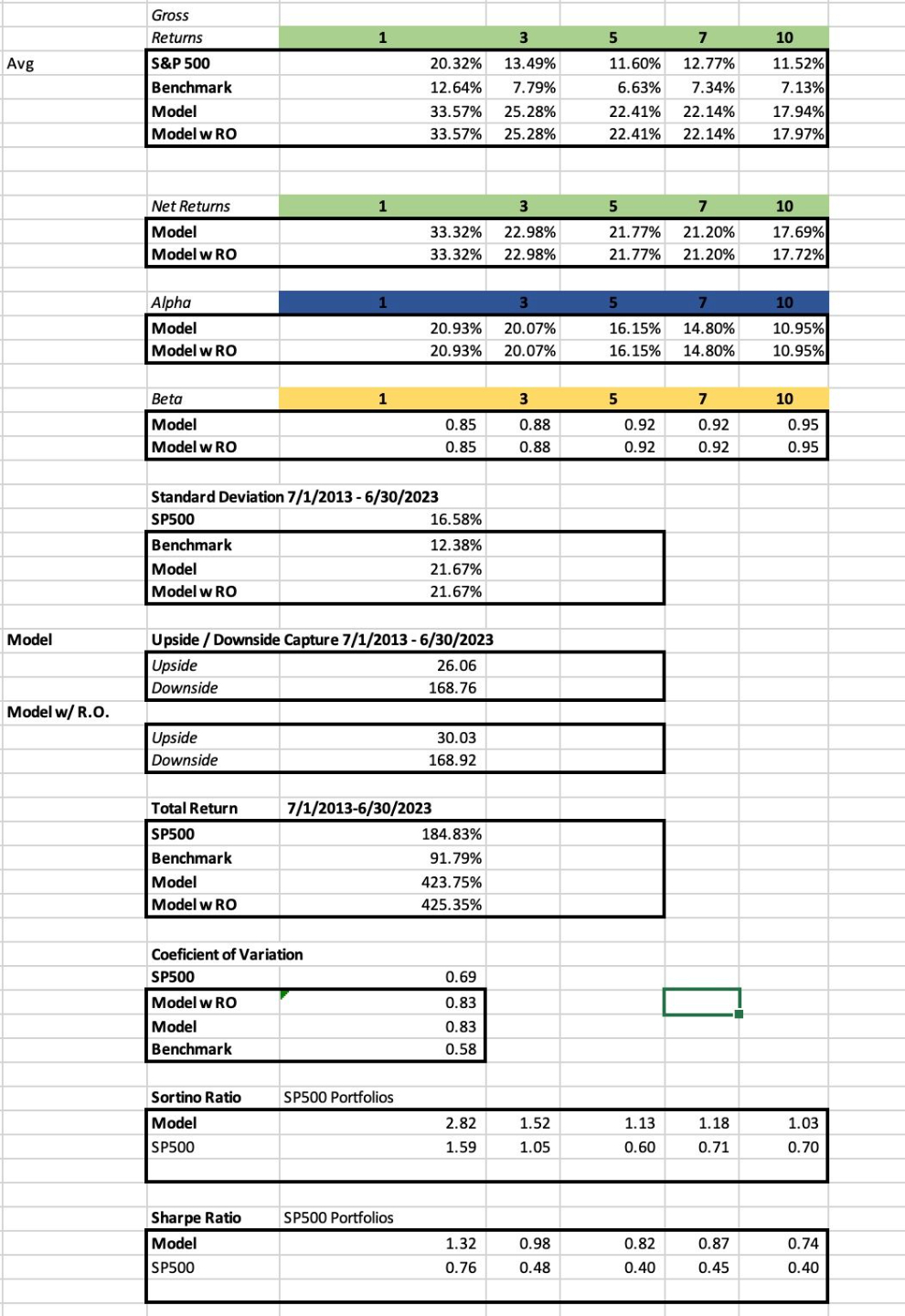

Case Study: The Model without Risk Overlay

All U.S. Stock Models (NYSE/Nasdaq) with no weekly Tactical Capital Weighted Volume risk overlay - following Lutey Growth 'CAN SLIM', Lutey Moderate Growth 'ACS', Lutey Value 'Buffet', and Lutey Growth 'Graham' in one portfolio - and no tactical allocation switching. Produces a higher return than the SP500 - it is not accompanied by a lower standard deviation too. Which the Lutey Recession Rule (Journal of International Finance and Economics - 2025) aims to do (evidenced in the first image above).

Take me to the portfolio with Risk Overlay