Volume Price Confirmation Indicator VBOT Strategy on Sector SPDR ETFs

May 23, 2025Volume Price Confirmation Indicator VBOT Strategy on Sector SPDR ETFs

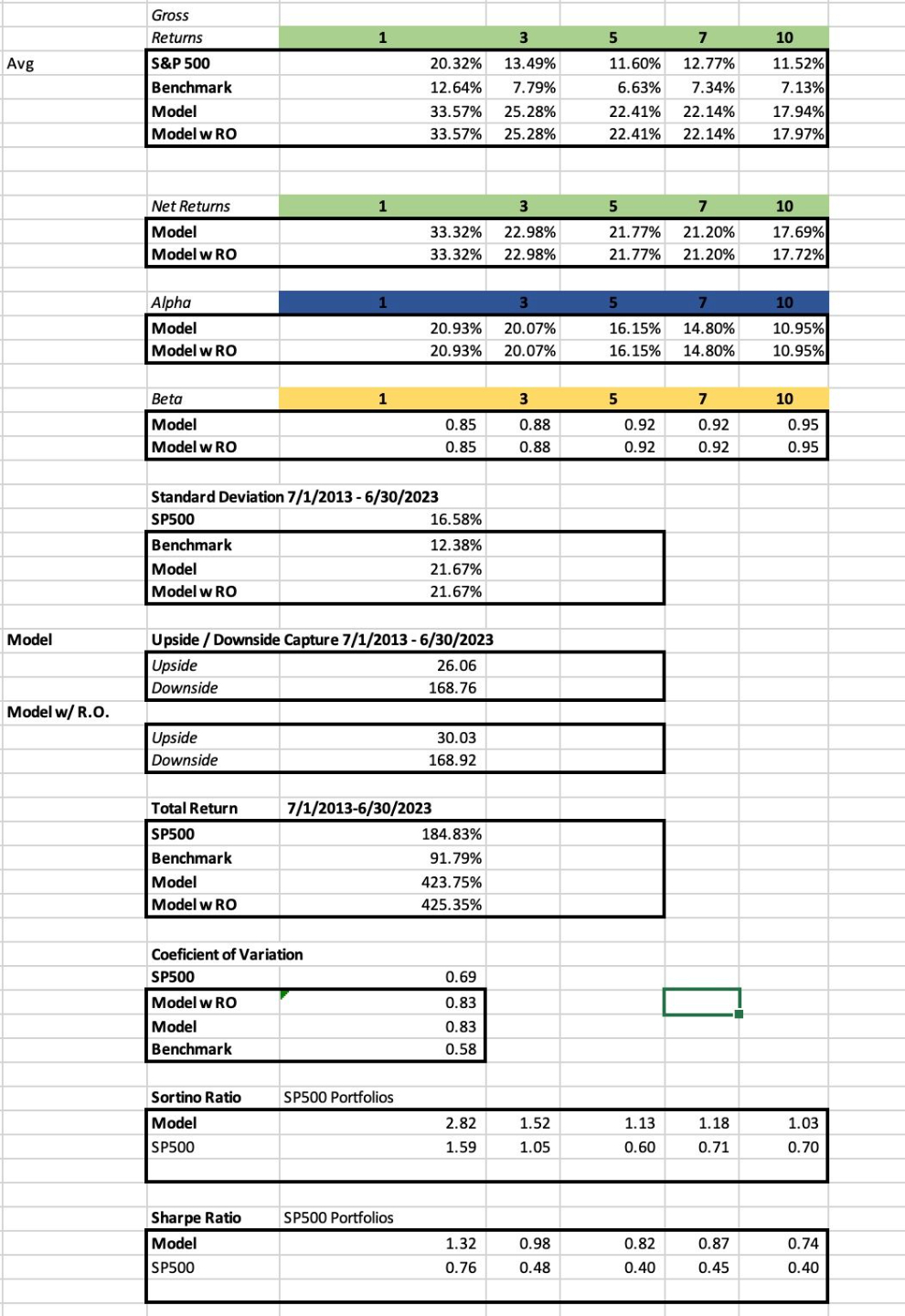

We construct the Volume Price Confirmation Indicator (VPCI) VBOT signal using the 11 S and P sector exchange-traded funds. The indicator is based on a lower standard deviation band below the simple average of the VPCI itself. The indicator is based on the differences between fast (5 period) and slow (20 period) simple moving averages (SMA) and volume weighted moving averages (VWMA) as well as the ratio between fast and slow volume averages (Vol Avg). The VBOT occurs when VPCI falls below its lower standard deviation band (and also below a threshold of −.4) and comes back above it. The signal determines a low risk buying opportunity with high profit potential. We test the returns and risk 30, 60 and 90 days after a signal. We benchmark on the returns and risk 30, 60 and 90 days before a signal. We also test a ‘W’ bottom (WBOT) which is two VBOT signals occurring within 20 days of each other. In this case we record the returns and risk 30, 60 and 90 days following the second VBOT signal. The indicator may have implications for individual, professional, and institutional investors who wish to manage risk in the Sector ETFs.

- Hope to provide more detail or feature of the paper soon.

- Key insights are that the VPCI VBOT strategy shows profit on most of the sectors using 30, 60, and 90 day time periods for holding after a signal occurs.