Lutey Growth - CAN SLIM Investing Portfolio

CAN SLIM Investing Style — Summary

CAN SLIM is a growth-at-the-right-time stock-selection system developed by William O’Neil. It blends fundamental earnings growth, price momentum, institutional demand, and market timing to identify stocks early in major advances.

The philosophy is simple:

Buy the market’s strongest growth companies before their biggest price runs, and only when the overall market supports risk-taking.

The paper emphasizes that CAN SLIM is not purely momentum-based. Instead, it targets companies with:

- Explosive earnings growth

- Strong price action near highs (not beaten-down stocks)

- Institutional sponsorship (but not overcrowded trades)

- Favorable market conditions

What Each Letter in CAN SLIM Means (Condensed)

From the paper’s description and implemented screens:

C – Current Quarterly Earnings

Strong recent quarterly EPS growth relative to other stocks.

A – Annual Earnings Growth

Sustained earnings growth over multiple years.

N – New (Catalysts / Highs)

Stocks making new highs or near highs, often driven by innovation, new products, or momentum.

S – Supply and Demand

Strong price performance indicates demand overwhelming supply.

L – Leader, Not Laggard

Buy leading stocks in leading industries.

I – Institutional Sponsorship

Stocks with meaningful—but not excessive—institutional ownership.

M – Market Direction

Only buy aggressively when the overall market trend is positive.

Invest in the Lutey Growth - CAN SLIM PortfolioLutey Growth - CAN SLIM: All U.S. Stock (NYSE/NASDAQ) Components

CAN SLIM Model — Highest Return, High Volatility Growth Engine

Return Profile

Total Return: 375.7% (vs 184.8% S&P 500)

Annualized Return (10-yr): 17.2%

Alpha: +10.2% to +21.0%

Upside Capture: 124%

Downside Capture: 141%

Risk Profile

Volatility (Std Dev): 20.4% (vs 16.6% S&P)

Beta: ~0.85

Sharpe Ratio: 0.75

Sortino Ratio: 0.97

Interpretation

Pure growth model designed to maximize absolute returns.

Strong upside participation with moderately elevated volatility.

Delivers massive alpha, but also experiences larger drawdowns during market stress.

Best Use Case

Core growth engine for aggressive investors.

Works extremely well when paired with defensive overlays or diversification sleeves.

Send me Free Passing Stocks

A real time $400,000 case study

The Lutey Growth 'CAN SLIM' portfolio applied to the SP500 components in real time February 2025. The passing stocks were held with a model $400,000 portfolio in portfolio123.com as a live forward tested study.

The performance of the model is 21.61% over the past 12 months (as of Jan 2026). The red line in the image below represents the growth of the portfolio from the initial rebalance in February 2025 during the last 12 months.

Lutey Growth: SP500 CAN SLIM Model

CAN SLIM Growth: 15–21% Annual Returns with half the Market Risk

15–21% Annual Returns

Beta ~0.60

250%+ Upside Capture

Growth Engine.

Market Shield.

Compounding Capital.

Outperforms S&P 500 with half the beta—rules-based CAN SLIM for advisors and clients.

CAN SLIM Growth Model: Efficient Equity Exposure with Reduced Market Sensitivity

The CAN SLIM Growth Model is designed for investors seeking systematic equity growth with materially lower market dependence, while maintaining strong long-term compounding characteristics.

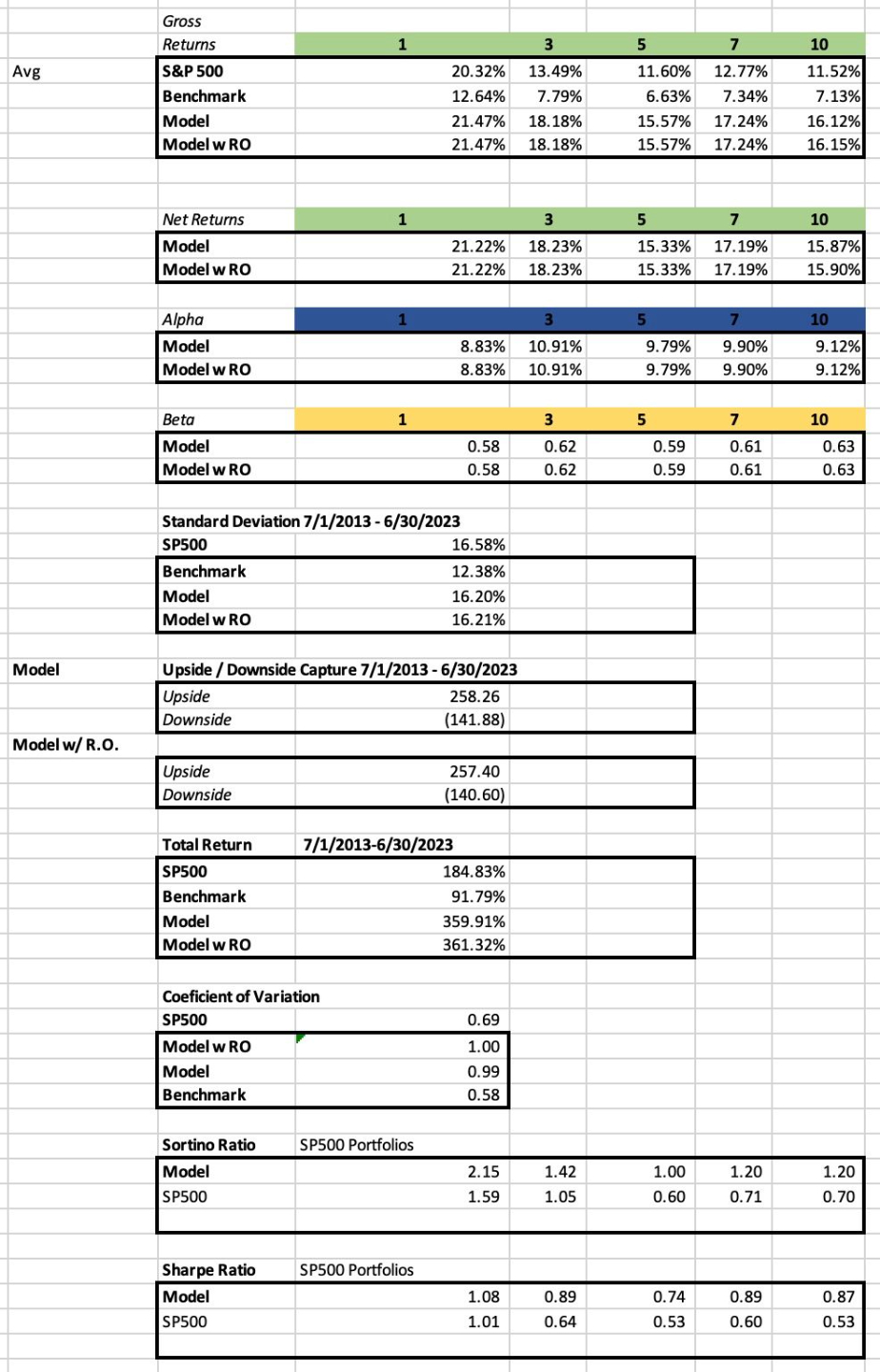

Over the full market cycle from 7/1/2013 to 6/30/2023, the model delivered meaningful outperformance versus traditional benchmarks, achieved with approximately 60% market beta and volatility comparable to the S&P 500.

Key characteristics:

-

Consistent excess returns: Annualized net returns ranged from approximately 15%–21% across 1-, 3-, 5-, 7-, and 10-year horizons.

-

Sustained alpha generation: Alpha remained positive and stable across all timeframes, averaging ~9–11%, indicating returns driven by stock selection rather than market exposure.

-

Low beta profile: Beta remained near 0.60, reducing sensitivity to broad market drawdowns.

-

Competitive risk-adjusted performance: Sharpe and Sortino ratios exceeded those of the S&P 500 across every evaluated horizon.

-

Strong upside participation with downside discipline: The model captured more than 250% of market upside, while materially reducing downside exposure during negative periods.

The strategy applies the CAN SLIM growth framework in a rules-based, quantitative implementation, removing discretion and emotional bias. Positions are selected based on earnings growth, price momentum, and market confirmation signals, and are dynamically managed as market conditions evolve.

For advisors, the CAN SLIM Growth Model offers:

-

A transparent, repeatable growth allocation with reduced market beta

-

A strong satellite or core-growth sleeve alongside traditional equity holdings

-

A model that historically delivered growth-style returns without full equity risk

For clients, the experience is straightforward:

A disciplined growth strategy designed to compound capital while avoiding unnecessary exposure during unfavorable market environments.

A tactical weekly real time look at the Lutey Growth - CAN SLIM

The Lutey Growth 'CAN SLIM' model with weekly rebalancing. This significantly cuts the risk out of the portfolio by applying a tactical risk overlay.

This lowers the standard deviation of the portfolio from 23% to 17% while preserving the high return. It uses the passing stocks each week and decision for whether to be in the market or not to reduce exposure during market downturns and gain an edge during the market upswings.

View the Model

Lutey Growth - CAN SLIM: All U.S. Stock (NYSE/NASDAQ) Components

w/ Weekly Tactical Risk Overlay

271% Total Returns

Beta ~0.27

-65% Downside Capture

CAN SLIM Alpha.

Risk Compressed.

Compounding Capital.

14.4% annualized with massive drawdown protection—core growth for advisors and clients

High-Alpha Growth with Strong Risk Compression

Return Profile

Total Return: 271.3% (vs 184.8% S&P 500)

Annualized Return (10-yr): 14.4%

Alpha: +7.7% to +15.7%

Upside Capture: ~-35%

Downside Capture: ~-65%

Risk Profile

Beta: ~0.27

Volatility: 18.0% (vs 20.4% all-stock CAN SLIM)

Sharpe Ratio: 0.71

Sortino Ratio: 0.77

Interpretation

Tactical overlay materially reduces market exposure while preserving most of the growth premium.

Converts CAN SLIM from an aggressive growth engine into a risk-managed alpha strategy.

Sharpe improves despite lower raw returns.

Best Use Case

Growth investors who want CAN SLIM alpha with drawdown control.

Ideal as a core growth sleeve in advisor portfolios.

Ready to Build Your All-Weather Portfolio?

Pick your strategy session:

15 min – (Initial Contact)

30 min – (Full roadmap)

We'll map your Lutey model mix and tactical overlays. What's your top risk/return priority?

Build a Portfolio | Book a strategy call