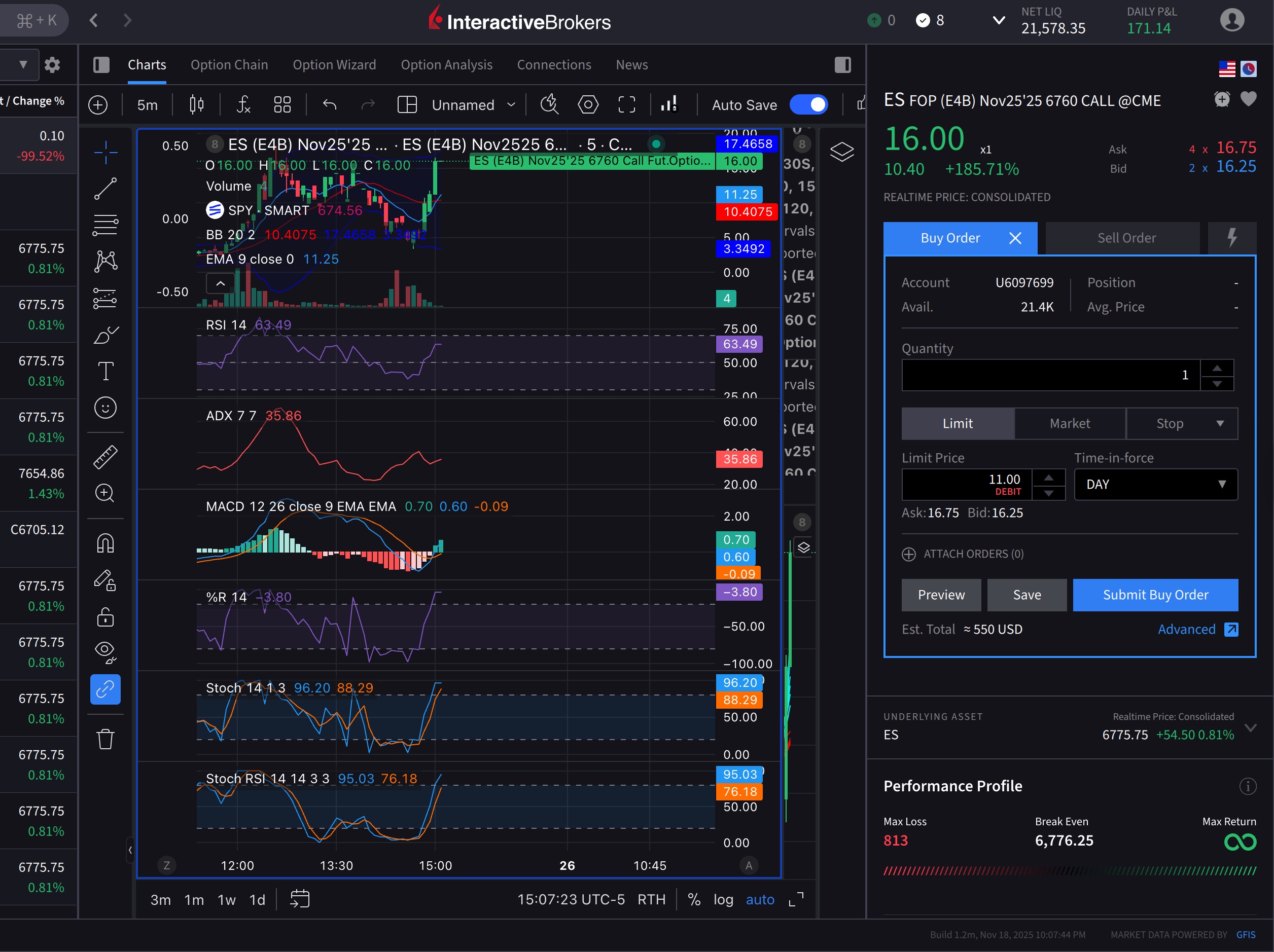

Futures and Options is Open

Dec 02, 2025I put together a course on futures and options. It covers technical trading signals I use on them. For example:

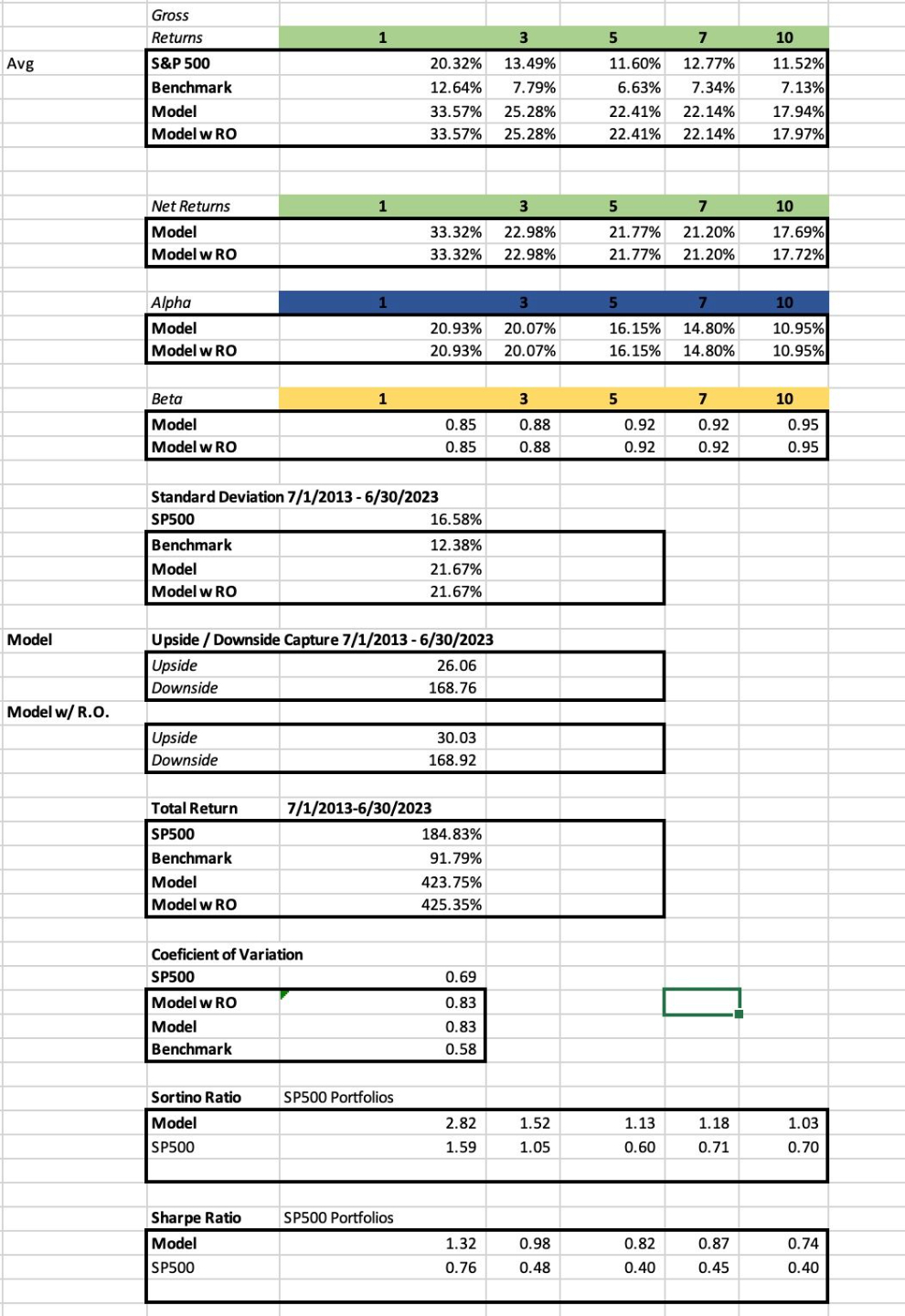

This $5.95 call option was a good buy signal following my trade book rules at 2:50pm. 10 minutes later it popped up to $11.25 making it a almost 2:1 trade with $300 risk.

Looking back at the move down that started this buy signal at 1:45 it dropped in premium from $15 to $3 where it made a good buy signal. This is a $600 move in option money with $750 initial outlay.

These are not typical moves that I cover but when looking at the short trade I took, the put option rose from $2.70 to $7 over the same timeframe which is also just over 2:1 with $135 in risk becoming $350. This is also not part of my trade book.

My trade book set ups are typically in the 4:1 or more range. The purpose of this is to minimize your risk while consistently betting and booking the profits. The advanced day trade mastery program covers this type of move.

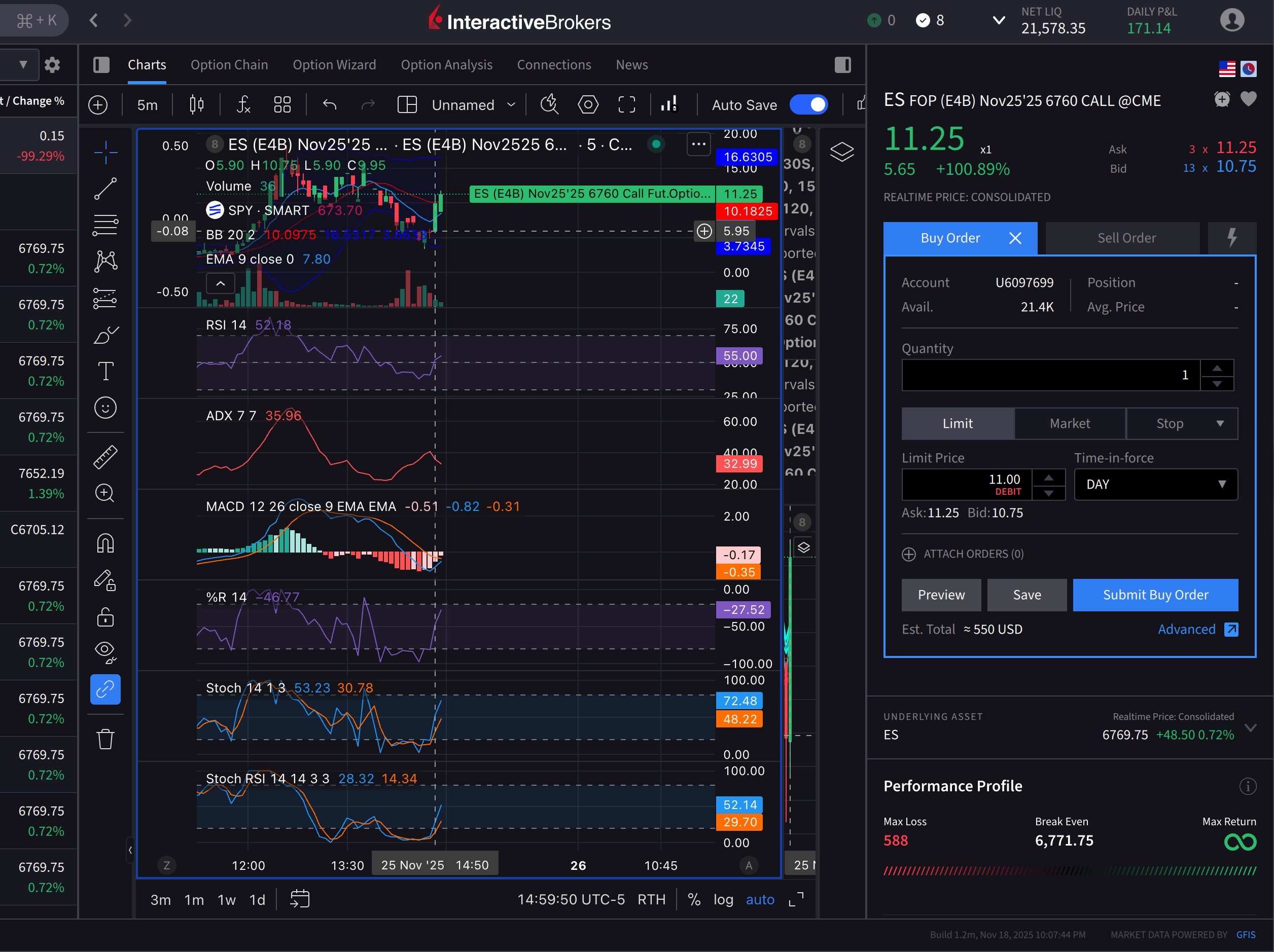

The Blog image shows a move I took in Dubai which was 4:1. An initial $1,670 risk became $5,800. From one of my A set ups. As I'm writing I'm watching the option move I posted above go from $11 to $16 on the bullish momentum.

This came from a reversal from the sell move I covered earlier and on my YouTube. The buy reversal looked good and I did not take it since I am already at my profit target for the day.

I cover how to overcome common pitfalls like how to manage risk and emotions when trading in the program. The 4:1 Dubai trade came from a price rollover in my trade book.

I cover trades like this on my e-mail list and in my day trading course. The goal is to bring your account up from simulator to real money.