Are We Headed for Another Bubble? What You Need to Know About the Housing and Stock Markets Right Now

Nov 25, 2025The economy is a fascinating, unpredictable beast, isn’t it? One minute, we’re riding high on growth and optimism, and the next, we’re staring down the barrel of a potential correction—or worse, a crash. If you’ve been paying attention to the housing market and the stock market lately, you might be wondering: are we in a bubble? And if so, what happens next?

Let’s break this down together.

The Housing Market: A Bubble Waiting to Pop?

Housing prices have been climbing steadily for years now, and affordability is becoming a real issue for many people. It’s easy to look at this and think, “This can’t last forever.” And you’re right—it probably won’t. But here’s the thing: housing markets don’t tend to crash overnight. They’re more like a balloon with a slow leak than a bubble that pops dramatically.

Back in 2008, the housing market collapse was fueled by reckless lending practices, over-leveraged banks, and a lack of regulation. Today, lending standards are tighter, and banks are better prepared. So while a correction could happen, it might not be as catastrophic as what we saw back then. Think more along the lines of a gradual deflation rather than a sudden implosion.

If prices were to come down, they might settle back to levels we saw around 2014-2015. That’s still a significant drop, but it’s not the end of the world—especially if you’re in it for the long haul.

The Stock Market: Frothy or Fundamentally Sound?

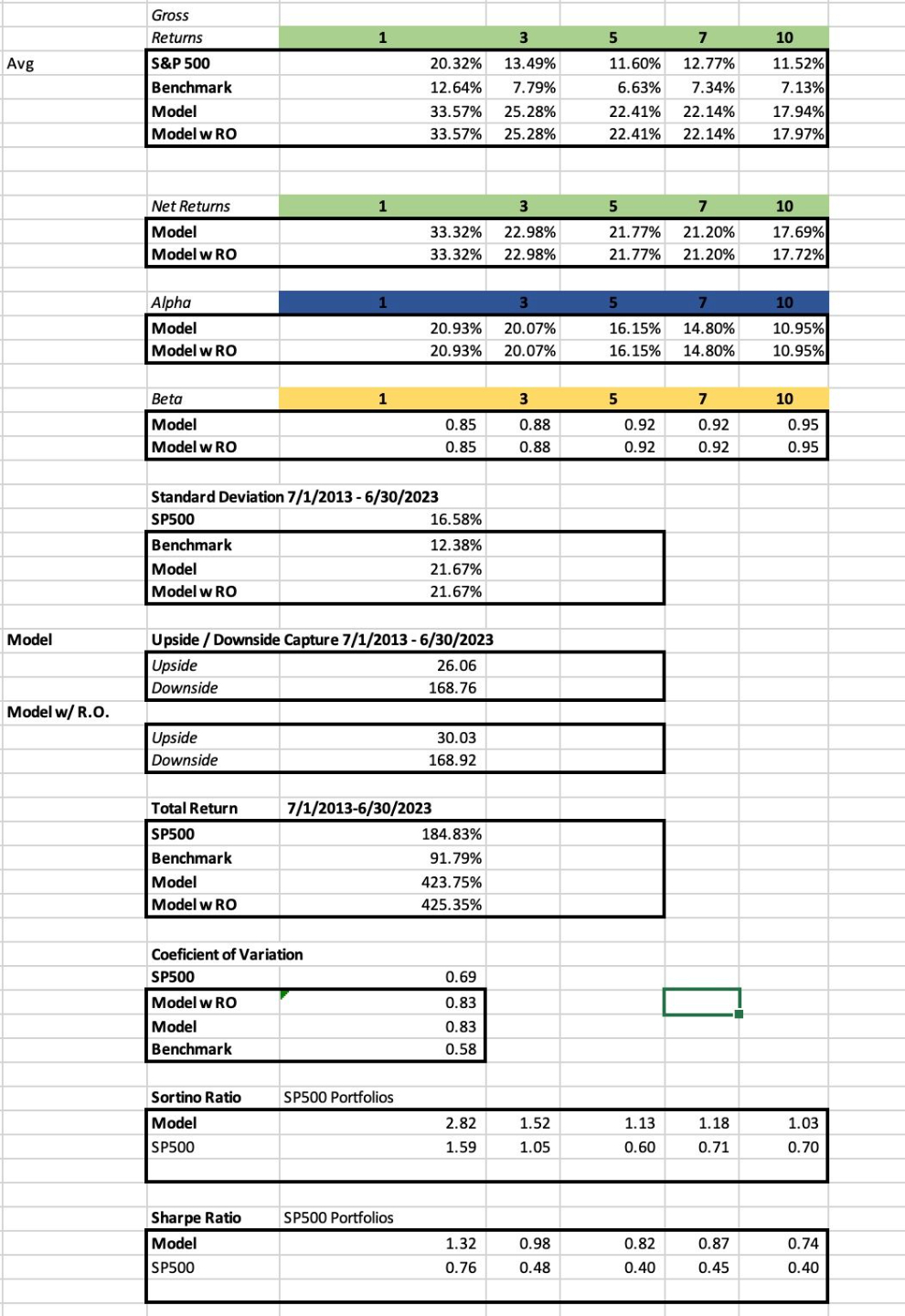

The stock market is a different animal. After the COVID-19 recovery, we saw a surge in stock prices that felt a little... frothy. But here’s the thing: much of that growth was a fundamental catch-up. Companies were recovering, profits were rebounding, and the market was reflecting that.

For a true bubble to form, we’d need to see prices deviate significantly from fundamentals—think of the dot-com bubble in the late ’90s or the housing bubble in the mid-2000s. Right now, certain sectors might be overvalued, but the market as a whole seems more grounded.

That said, markets are cyclical. A downturn will come eventually—it always does. The question is, what will trigger it? A geopolitical event? A sudden spike in interest rates? A black swan event we can’t predict? Your guess is as good as mine.

What Should You Do?

Here’s the deal: trying to time the market or predict the next crash is a losing game. Instead, focus on what you can control. Here are three steps you can take right now to protect yourself and your investments:

-

Diversify, Diversify, Diversify

Don’t put all your eggs in one basket. Spread your investments across different asset classes—stocks, bonds, real estate, even cash. That way, if one market takes a hit, you’re not wiped out. -

Think Long-Term

Markets go up and down, but over time, they tend to recover and grow. If you’re investing for the long haul, a correction isn’t something to fear—it’s an opportunity to buy at a discount. -

Keep Cash Reserves

Whether you’re an investor or a homeowner, having cash on hand is crucial. It gives you the flexibility to weather downturns and take advantage of opportunities when they arise.

Final Thoughts

Look, no one knows exactly what the future holds. But here’s what I do know: the economy is resilient. We’ve been through recessions, crashes, and crises before, and we’ve always come out the other side. The key is to stay calm, stay informed, and stay focused on your goals.

So, what’s your next move? Are you looking to invest, or are you just trying to make sense of it all? Let’s keep the conversation going in the comments below.

Stay current on the latest updates to the Housing Market and US Stock and Price to Dividend Ratio - download the excel graphs used in the Video (free): https://www.drmattlutey.com/pl/2148693315

View the recent video breaking down the US housing and Stock Market state and current bubble activity: https://vimeo.com/1104953866/696735e1f2?ts=0&share=copy