Lutey Recession Indicator

Lutey Recession Timing Indicator

Recession Signal is Active

The thesis of Lutey Recession Indicator

The Lutey Recession Indicator aims to predict recessions and forecast how long they will last.

It's based on the principle that interest rate inversions typically precede a recession due to market uncertainty. Recessions usually bring a sharp sell-off in stock prices, leading to a moving average crossover. The Lutey indicator combines these two concepts into a single recession timing tool.

Fama and French (2019) cover the lack of ability of interest rate inversion to forecast a recession and Lutey and Rayome (2020) cover combining both interest rate inversion and moving average crossover signals to improve timing prior to the historical recession periods.

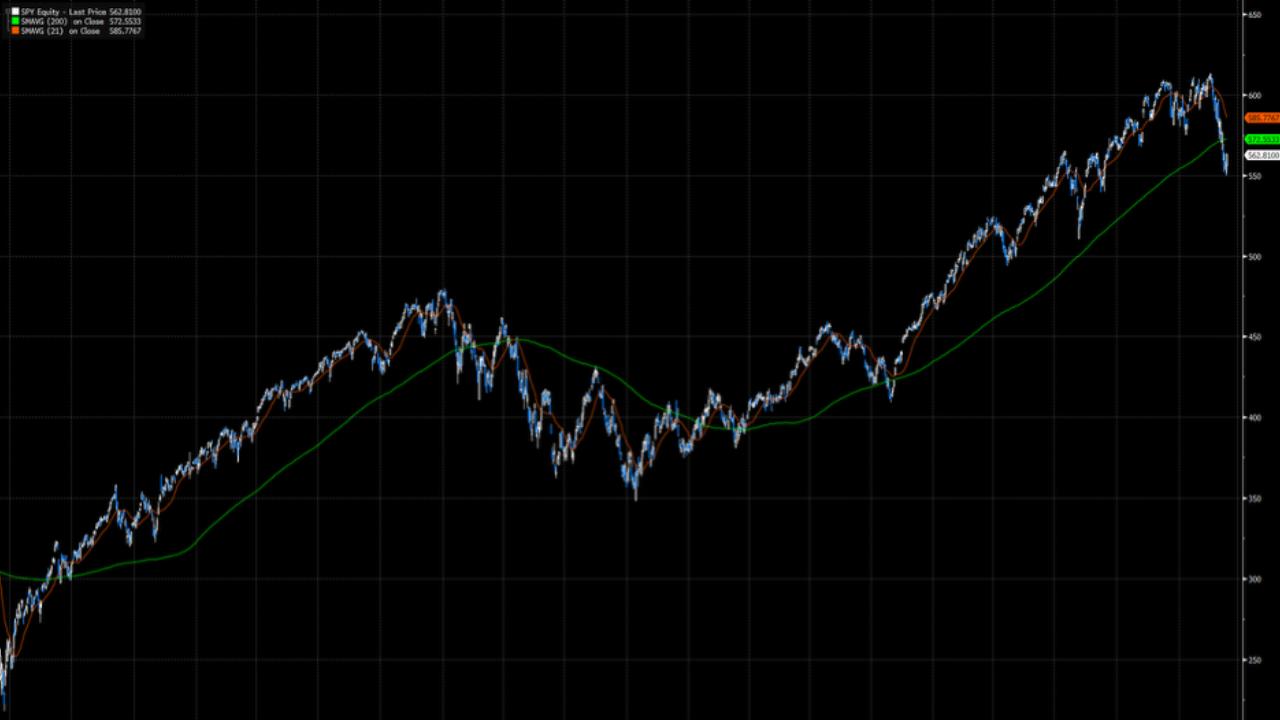

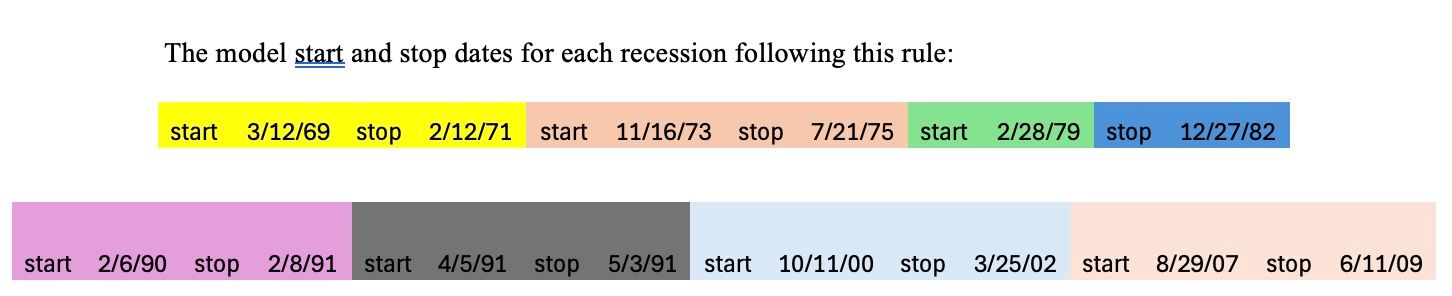

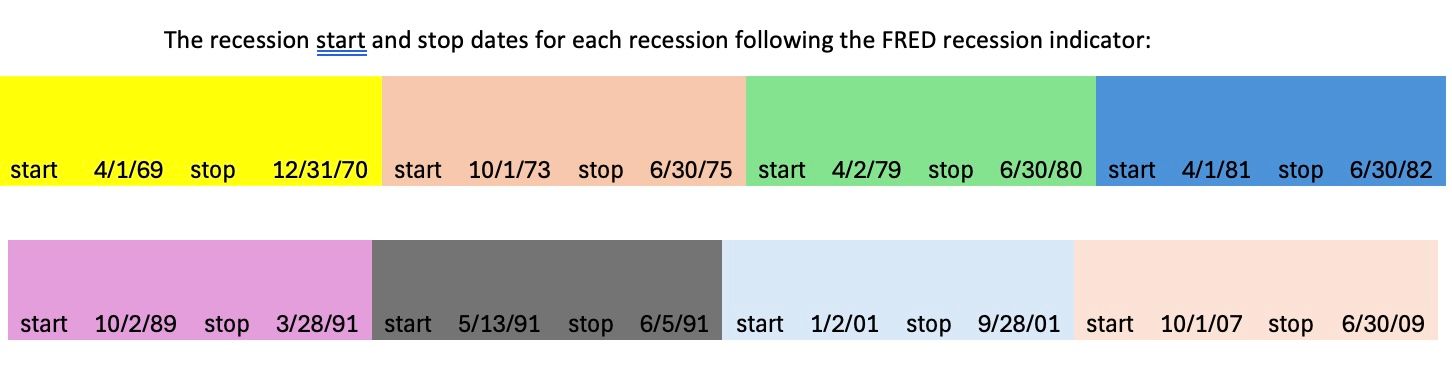

Lutey Recession Indicator exits the market when daily moving average 21 is below daily moving average 200 on the SP500 index and interest rates have been inverted for at least three consecutive months prior to the crossover. The indicator was applied to the historical recession periods starting in 1969 through 2008. The interest rates used are 1 year 5 year and 1 year 10 year, when one of those are inverted for three consecutive months Lutey Recession indicator exits the market following a 21 day 200 day moving average cross. The indicator stays out of the market for as long as the moving average crossover is valid, or the length either of the rates were inverted prior to the crossover starting 272 days prior to the crossover, plus any new rate inversions that occured during the crossover, or new crossover that occured after new rate inversion.

Built on years of research, trusted by disciplined traders.

The Lutey Recession Indicator simplifies macro timing for everyday investors.

Basic

Built on years of research, trusted by disciplined traders.

The Lutey Recession Indicator applies market technical tools for more serious client driven results.

IntermediateCRSP Study

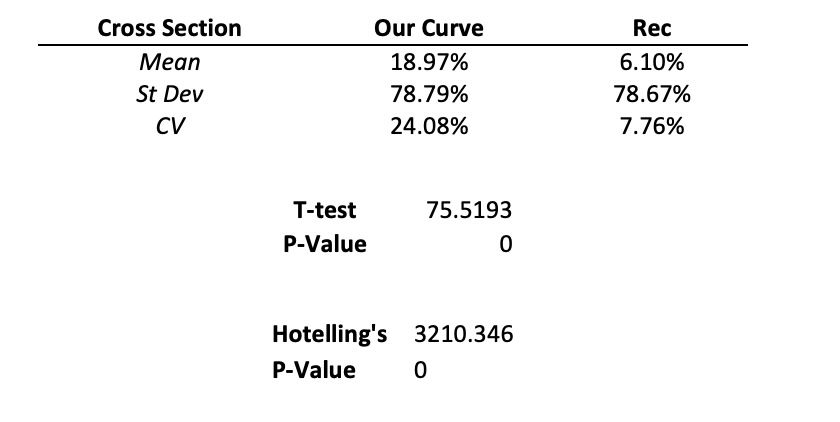

This rule, when applied to every recession since 1969 using the Center for Research in Security Prices (CRSP) database, yields the following statistics:

Built on years of research, trusted by disciplined traders.

Advanced Macro Intelligence: Hedging, Sector Rotation, and Volume Signal Detection with the Lutey Recession Indicator.

Advanced